city of richmond property tax inquiry

A service fee of 200 of tax or utility payments will be added to the payment amount to offset the service. Real Estate Taxes are assessed on all land buildings and any other improvements attached to the land and completed as of January 1 st of each tax year.

Paying Your Property Tax City Of Terrace

Drop Box at City Hall.

. Understanding Your Tax Bill. Search by Parcel IDMap Reference Number. Due Dates and Penalties for Property Tax.

Real Estate Taxes are billed once a year with a December 5 th due date. By Richmond City Council. Richmond Va Property Tax Invoice Lookup.

Ad Find Richmond Property Tax Info From 2022. Search for Richmond Property Taxes. Other Services Adopt a pet.

To pay your 2019 or newer property taxes online visit the Ray County Collectors websiteAll City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the Ray. 1 View Download Print and Pay Richmond VA City Property Tax Bills. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established.

The propertys Parcel ID should be entered such as W0210213002. Search by Property Address Search property based on street address. If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000.

Real Estate taxes are assessed as of January 1 st of each year. The Property Search online system is unavailable at this time due to scheduled maintenance. See Property Records Deeds Owner Info Much More.

For example entering W0210213 will display the. Billing is on annual basis and payments are due on December 5 th of each year. Personal Property Taxes are billed once a year with a December 5 th due date.

City of Richmond Parcel Tax Search. 3 Road Richmond British Columbia V6Y 2C1 Hours. Late payment penalty of 10 is applied on December 6 th.

Ad Online access to property records of all states in the US. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. In case of an emergency call the City of Richmond 24 Hour Call Centre at 604-244-1262.

All City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019. Monday - Friday 8am - 5pm. Property Value 100 1000.

Informal Formal Richmond City Council Meetings - September 12 2022 at 400 pm. Assessments Pursuant to the Code of Virginia all real estate assessments are valued at 100 of. 1000 x 120 tax rate 1200 real estate tax.

For more information please call 804 646-6474. Public Information Advisory - Richmond City Council Standing Committee. Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond.

Finance Taxes Budgets. Access City of Virginia Official Website. Other Services Adopt a pet.

Partial Parcel ID may be entered but at least 8 digits should be entered in order to activate the auto suggestion. While our partners work directly with the Treasurer to provide resources or link our ambassadors to the community. Discover public property records and information on land house and tax online.

Property value 100000. Report a Problem Request a Service. To contact City of Richmond Customer Service please call 804-646-7000 or 3-1-1.

Interest is assessed as of January 1 st at a rate of 10 per year. Failure to receive a tax bill does not relieve you of the. Obtain a free uncertified Property Report on any Richmond property.

In Person at City Hall. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Use this form to report non-emergency concerns regarding your property services and utilities or problems in your neighbourhood like street lights out or pot holes.

Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website. 295 with a minimum of 100. Search in Richmond County Now.

Visa MasterCard and American Express accepted. If you are interested in serving as an Ambassador or Partner please complete the Financial Empowerment Interest Form and send it to the City Treasurers Office for review. Connect To The People Places In Your Neighborhood Beyond.

Electronic Check ACHEFT 095. Broad Street Richmond VA 23219. Selecting options for consulting taxes.

Manage Your Tax Account. The City Assessor determines the FMV of over 70000 real property parcels each year. Please try again later.

Real Estate and Personal Property Taxes Online Payment. Search Any Address 2. Property Tax Vehicle Real Estate Tax.

604-276-4000 City of Richmond. Check the Current Taxes Value Assessments More. Property Tax Vehicle Real Estate Tax.

You can also purchase Tax certificates in person by visiting the Property Tax Department on the main floor of City Hall.

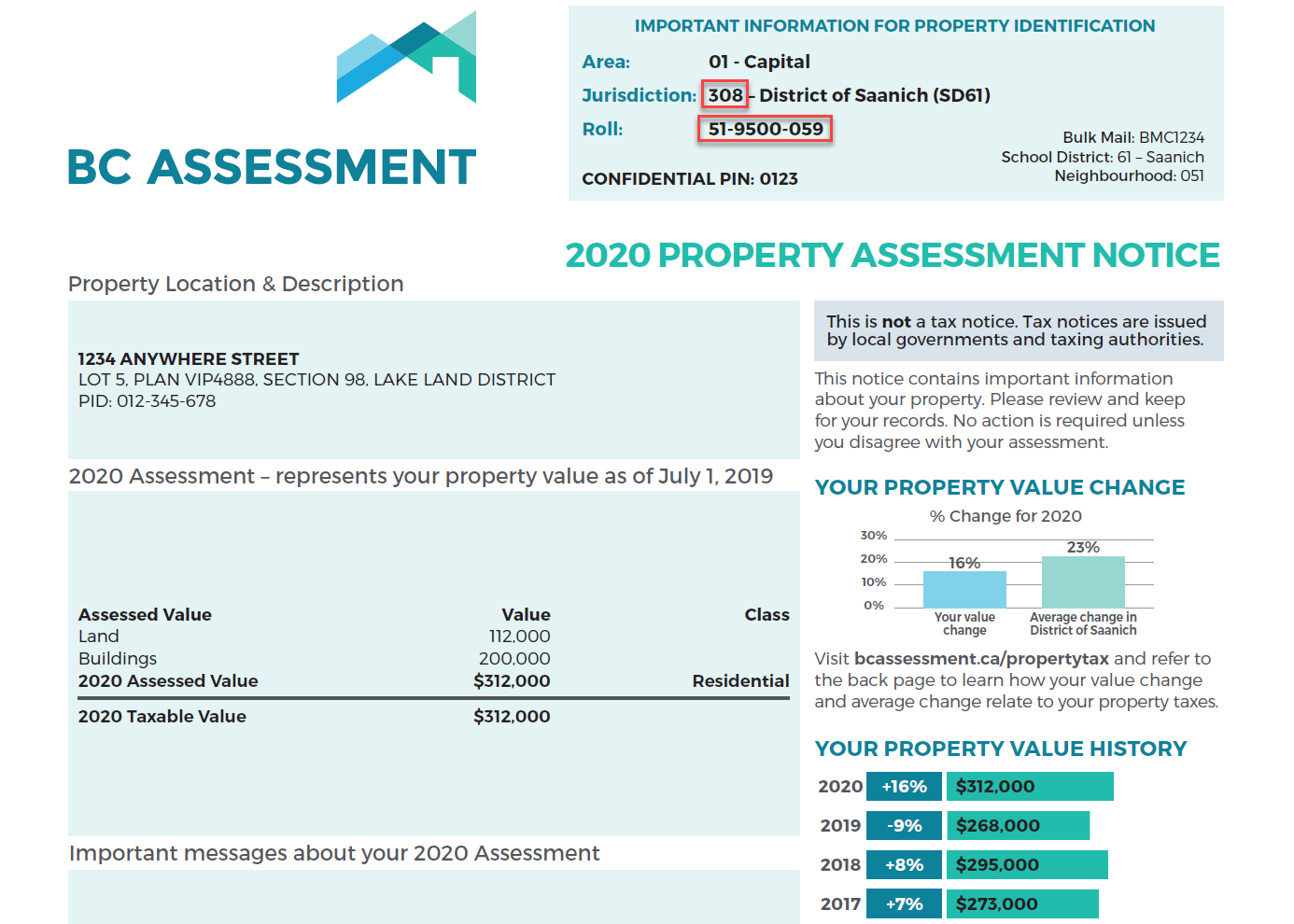

Property Assessment Assessment Search Service Frequently Asked Questions

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Municipal Property Assessment Mpac City Of Richmond Hill

276 Bass Street Real Estate Trends Real Estate Tips Sight Sound

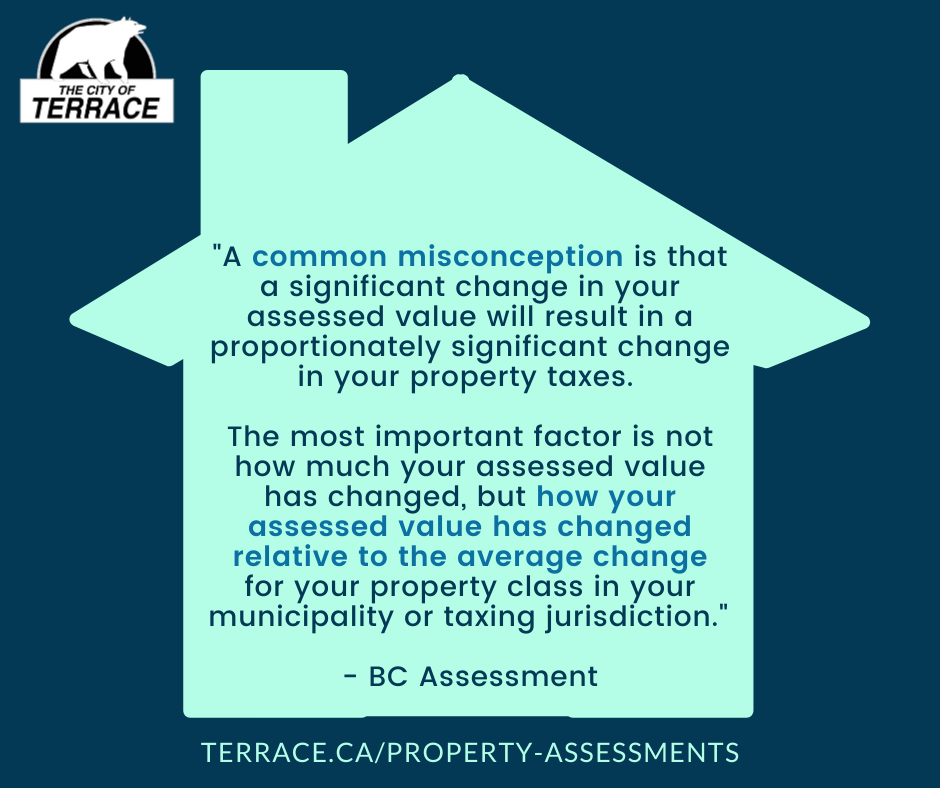

Property Assessments City Of Terrace

Property Tax Billings City Of Richmond Hill

Where Do I Find My Folio Number And Access Code Myrichmond Help

Where Do I Find My Folio Number And Access Code Myrichmond Help

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Northern Bc Region Property Assessments

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Property Assessments City Of Mission

Ontarians Face Growing Property Tax Burden In Many Municipalities Fraser Institute